Active Transportation Fund - Applicant Guide for Capital Projects

Active Transportation Fund at a Glance

Active transportation refers to the movement of people or goods powered by human activity. Active transportation includes walking, cycling and the use of human-powered or hybrid mobility aids such as wheelchairs, scooters, e-bikes, rollerblades, snowshoes and cross-country skis, and more.

Active transportation provides tangible benefits to communities, shortening commute times for families, creating employment opportunities, growing the economy, promoting healthier lifestyles, promoting equity amongst vulnerable Canadians, cutting air and noise pollution, and reducing greenhouse gas emissions.

The Government of Canada has allocated $3 billion annually on average beginning in 2026-27 for permanent public transit programming under the Canada Public Transit Fund (CPTF), a historic investment that will support transit and active transportation in communities of all sizes across Canada. The Active Transportation Fund (ATF) is being launched under the Targeted Funding Stream of the CPTF. The Targeted Funding stream of the CPTF will consist of a series of regular calls for applications for specific types of public transit and active transportation projects. Targeted Funding intakes will vary and provide flexible, call-specific funding to address federal priorities that meet local needs.

Table of Contents

- 1. Objective of the Active Transportation Fund

- 2. Capital Projects Eligible for Funding

- 3. Eligible Recipients

- 4. Application Process

- 5. Environmental Assessment and Duty to Consult

- 6. Additional Information

1. What is the Objective of the Active Transportation Fund?

The Active Transportation Fund aims to advance the objectives of the Canada Public Transit Fund, and those embedded within Canada’s National Active Transportation Strategy, and Canada’s Strengthened Climate Plan. As such, the ATF will aim to support projects that:

- Increase the use of active transportation relative to car travel and increase the use of public transit by supporting first and last kilometer connections to existing and planned infrastructure;

- Increase affordability by providing economic value to communities and providing cheaper travel options over vehicular travel;

- Support efforts to mitigate climate change and improve climate resilience by reducing road congestion and cutting air and noise pollution; and

- Improve active transportation options for all, especially Indigenous People and equity-deserving groups to ensure people of all ages and abilities can access jobs and services.

Through supporting projects that will increase the total amount, usage, and quality of active transportation infrastructure throughout Canada, the ATF will support projects that encourage a modal shift away from cars and towards active transportation.

2. Capital Projects Eligible for Funding

Capital projects refer to new infrastructure construction, enhancement of existing infrastructure, and fixed design and safety features that encourage increased active transportation. For a capital infrastructure project to be eligible for funding, it must include the acquisition, enhancement, modernization, rehabilitation, construction, expansion, restoration, renovation, repair, refurbishment, or replacement of active transportation infrastructure or networks.

Eligible capital projects may include:

- Building or enhancing infrastructure for active transportation, such as multi-use paths, sidewalks, footbridges, separated bicycle lanes, and connections to other roadways (this could include recreation trails provided they can also be used for transportation, i.e. connecting to destinations, services, or amenities);

- Enhancing active transportation infrastructure, including design considerations in which there may be no net gain in kilometers of infrastructure, but include quality improvements that support greater usage;

- Building or enhancing design features and facilities which promote active transportation, such as storage facilities, lighting, greenery, shade, and benches;

- Building or enhancing safety features which promote active transportation, such as crosswalks, speed bumps, fences, and wayfinding signage.

Ineligible projects include:

- Proposals to build or enhance infrastructure for which the primary users would be passenger and commercial vehicles;

- Costs related to furnishing and non-fixed assets, which are not essential for the operation of the assets included in the project.

For questions on project eligibility, please contact the ATF team at: ATF-FTA@infc.gc.ca.

3. Eligible Recipients

An applicant must be a legal entity capable of entering into legally binding agreements. To be considered an eligible recipient, applicants must fit within one of the following categories:

- A municipal, local or regional government established by or under provincial or territorial statute;

- A provincial or territorial government;

- A public sector body that is established by or under provincial or territorial statute or by regulation or is wholly owned by a province, territory, municipal or regional government, including, but not limited to:

- Municipally-owned corporations (for example, autonomous organizations owned by municipalities, used to produce or deliver local public services outside the local bureaucracy);

- A provincial or territorial organization that delivers municipal services (for example, public utilities, community health services, economic development bodies);

- Any other form of local governance that exists outside of the municipality description (for example, local service districts);

- A federally or provincially incorporated not-for-profit organization or charity.

Eligible Indigenous Recipients include:

- Indigenous Governing Body*:

- A band council within the meaning of Section 2 of the Indian Act;

- A First Nation, Inuit or Métis government or authority established pursuant to a Self-Government Agreement or a Comprehensive Land Claim Agreement between His Majesty the King in right of Canada and an Indigenous people of Canada, that has been approved, given effect and declared valid by federal legislation;

- A First Nation, Inuit or Métis government that are established by or under legislation whether federal, provincial or territorial that incorporates a governance structure;

- A federally or provincially incorporated not-for-profit organization whose primary purpose is to improve Indigenous outcomes; and

- Indigenous development corporations**.

Note:

* “Indigenous governing body” means a council, government or other entity that is authorized to act on behalf of an Indigenous group, community or people that holds rights recognized and affirmed by section 35 of the Constitution Act, 1982. “Indigenous peoples of Canada” has the meaning assigned by the definition aboriginal peoples of Canada in subsection 35(2) of the Constitution Act, 1982.

** Indigenous development corporations are normally set up by an Indigenous community/ organization/government. These corporations constitute the business/economic arm of Indigenous communities /governments and typically count the members of the community as their shareholders. Their primary role is to develop the economic activity of the Indigenous community that established them. Indigenous development corporations generally fall under two categories: for-profit and not-for-profit. The for-profit model however is unique in that profits are then re-invested in the community.

Ineligible recipients include:

- Individuals, private citizens;

- Federal entities, including federal Crown corporations; and

- Private sector entities.

Canada may enter into agreements with eligible recipients, who will directly undertake eligible projects. Canada may also enter into agreements with recipients, who will further distribute funding to one or more eligible ultimate recipients. Provincial legislation may require some organizations to obtain authorization prior to entering into Funding Agreements with Canada.

Applications which support activities that connect multiple administrative regions are eligible, so long as an ultimate recipient is identified by the proponent(s) in the application. Furthermore, Provincial and Territorial governments may make an application on behalf of municipal governments.

For any questions on eligible recipients, please contact the ATF team at: ATF-FTA@infc.gc.ca.

4. Application Process

4.1 How do I apply?

Applications will be accepted through Housing, Infrastructure and Communities Canada's online and accessible application portal. If you are unable to apply through the portal, please contact the ATF team at: ATF-FTA@infc.gc.ca.

4.2 What is the intake process?

Eligible applicants are invited to submit a project application through Housing, Infrastructure and Communities Canada’s Applicant Portal from December 12, 2024 to February 26, 2025. Indigenous applicants can submit their applications until April 9, 2025. The Step-by-Step Guide for Capital Projects provides comprehensive instructions on how to register for a Housing, Infrastructure and Communities Canada Applicant Portal Account, complete the application form and submit the required supporting documents.

Project selection will be merit-based; final project selection will be undertaken with a view to balancing funding support by taking into consideration such factors as regional distribution, the type of project, and equitable access.

The final selection decision will remain at the sole discretion of the Minister of Housing, Infrastructure and Communities. All applicants will be notified of funding decisions and successful applicants will later be asked to sign a funding agreement.

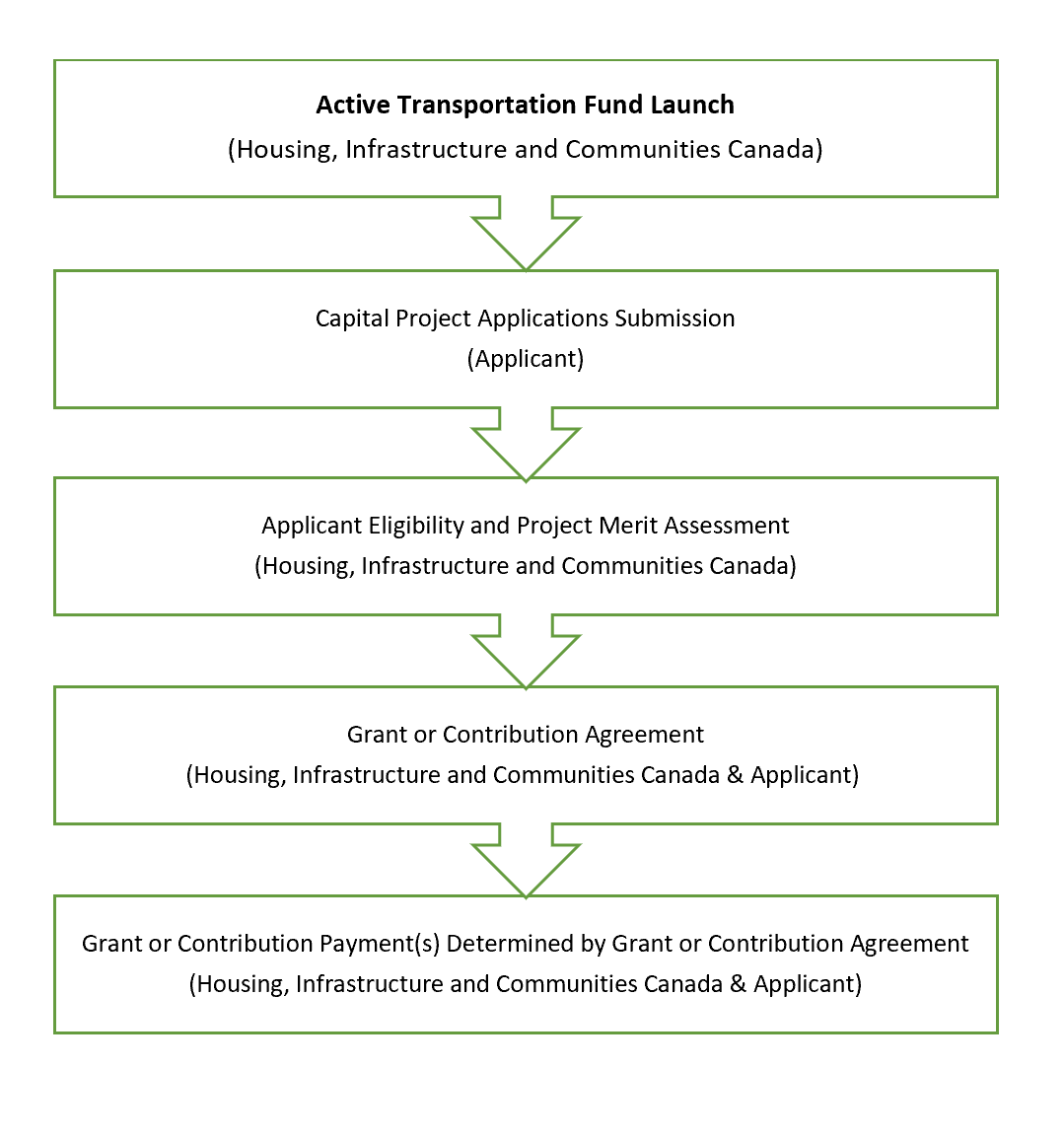

Stages of Application Process:

-

Text description of Graph 1: Stages of Application Process

Step 1: Active Transportation Fund Launch (Housing, Infrastructure and Communities Canada)

Step 2: Capital Project Applications Submission (Applicant)

Step 3: Applicant Eligibility and Project Merit Assessment (Housing, Infrastructure and Communities Canada)

Step 4: Grant or Contribution Agreement (Housing, Infrastructure and Communities Canada & Applicant)

Step 5: Grant or Contribution Payment(s) Determined by Grant or Contribution Agreement (Housing, Infrastructure and Communities Canada & Applicant)

4.3 How will applications be evaluated?

Applications will be evaluated based on the information provided and how it addresses the various elements below.

Economic Benefits

The project provides economic value to the community by supporting jobs within the community and/or by other proven methods.

Environmental and Climate Benefits

The project results in environmental benefits, such as implementing climate risk reduction and GHG mitigation measures into the design of the project.

Social Inclusion Benefits

The project improves active transportation mobility options for all, especially equity-deserving groups.

4.4 Application Requirements

Applicants will need to submit a comprehensive project proposal for their project to be considered for funding. Proposals should address the questions (not an exhaustive list) below:

Description of the Applicant and the Project

What organizational type is the applicant? What is the project about? What will the funding be used for? Where will it be implemented?

Objectives of the Project

What are the proposed outputs, and what objectives will the project ultimately advance?

Benefits of the Project

What are the proposed project benefits, be they economic, environmental, social? Who will benefit from the project?

Project Timeline and Budget

What are the forecasted/actual construction start and end dates? What are the estimated eligible costs, sources of funding, amounts?

Risk and Mitigation Measures

What risks might the project run into? What mitigation measures will be put in place?

5. Environmental Assessment and Duty to Consult

5.1 Environmental Assessment

HICC will review the application to determine whether the project has federal environmental or impact assessment requirements under the Impact Assessment Act (IAA), modern treaties or northern regulatory regimes. Under the IAA, designated projects may be subject to a federal impact assessment (Section 8) and projects on federal lands may be subject to an environmental effects determination (Section 82). HICC will inform funding recipients of any such requirement. No construction can start, and no funding can flow until environmental assessment requirements are met. Provinces and territories may also have environmental assessment requirements. More information is available on HICC’s website: Environmental Impact Assessment.

5.2 Duty to Consult

The Government of Canada has a duty to consult and, where appropriate, accommodate Indigenous peoples when it contemplates a decision or activity that might adversely impact Aboriginal or treaty rights. HICC will review the application to determine whether the project requires consultation with Indigenous peoples and inform the funding recipient. HICC will inform funding recipients of any such requirement. No construction can start, and no funding can flow until Indigenous consultation requirements are met. While the duty to consult rests with the Crown, HICC asks funding recipients to carry out certain procedural aspects of consultation, where appropriate. More information is available on HICC’s website: Consultation with Indigenous Peoples.

Engagement with Indigenous peoples prior to applying:

HICC encourages applicants to start a dialogue with Indigenous peoples potentially impacted by the project as early as possible, ideally during project planning and before applying for funding. This may build positive relationships with Indigenous communities and enhance project design by incorporating input and Indigenous Knowledge. Since the project may trigger a duty to consult, early discussions may mitigate potential impacts to rights and streamline consultation requirements at later stages. This can help avoid construction delays, as HICC cannot process claims until any consultation requirements have been met. More information is available on HICC’s website: Consultation with Indigenous Peoples.

The Aboriginal and Treaty Rights Information System (ATRIS) may be useful for mapping the location of Indigenous communities and obtaining information on their rights (see Annex C in the ATRIS user guide). See Step by Step Guide for Capital Projects for additional information.

A KML file showing the location of proposed project activities is required with every application. Instructions on how to create a KML file are included in the Step-by-Step Guide.

6. Additional Information

6.1 Maximum Program Contributions for Capital Projects

The ATF includes a minimum funding-floor set-aside of 10% of total funds for Indigenous recipients. Considerations will be given to ensuring a distinctions-based distribution through the project assessment process.

| Maximum Program Contribution (up to) | Maximum Federal Contributions from all sources (up to)* | Total Canadian (i.e. federal, provincial, territorial, and municipal) Government stacking (up to) | |

|---|---|---|---|

| Projects located in Provinces | 60% | 60% | 100% |

| Projects located in Territories | 75% | 75% | 100% |

| Projects located in Indigenous communities | 100% | 100% | 100% |

* Excludes funding received from Canada Community Building Fund (CCBF), Canada Infrastructure Bank (CIB) or Canada Mortgage and Housing Corporation (CMHC), from which eligible Federal Contributions are eligible up to 100%.

6.2 Eligible Expenditures

Eligible expenditures are those considered to be direct and necessary for the successful implementation of an eligible project and excluding those explicitly identified in the Ineligible Costs section below.

Eligible expenditures for capital projects can include capital costs, design and planning costs, as well as costs related to meeting specific program requirements as outlined by HICC, including:

- Expenditures directly associated with joint federal communication activities and with federal project signage;

- Costs/expenditures incurred for consultation or engagement with Indigenous groups on the project*;

- Expenditures incurred for accommodation of adverse impacts on Aboriginal and Treaty rights;

- Incremental expenditures directly related to meeting specific program requirements, such as climate change and resiliency assessments; and

- The costs of the eligible recipients' employees may be included as an eligible expenditure provided that the use of employees or equipment pertains solely to the implementation of the project, and:

- There is a lack of private sector capacity to undertake the work; or,

- The work involves project specific expertise, or proprietary or specialized infrastructure or equipment that requires specific knowledge or skill of the recipient's employees; or

- A collective agreement requires the recipient to use their own unionized employees for certain project work.

* Expenditures can only be reimbursed to the recipient if a funding agreement is signed, project approval conditions are met, including, where applicable, confirmation that environmental assessment and Indigenous consultation and accommodation obligations have been met and continue to be met.

Project expenditures will only be eligible as of project funding approval, except for expenditures associated with environmental assessments and Indigenous consultation which are eligible before project funding approval. Costs can only be reimbursed if and when project funding is approved, the Contribution Agreement is signed, and conditions outlined in the Contribution Agreement are met. In order to be eligible, non-capital expenditures claimed retroactively must respect all relevant federal requirements. The decision on whether to provide funding retroactively would be subject to approval by Canada.

For Indigenous recipients only, eligible expenditures may also include legal fees for project-related activities, excluding those related to litigation or to the purchase of real property (land or buildings) and legal fees incurred by Indigenous peoples whose rights may be impacted by project activities funded by the program that are not reasonable, as determined by Canada.

Ineligible expenditures include:

- Project costs incurred prior to project approval. Capital project costs incurred before project approval, except for expenditures associated with environmental assessments and Indigenous consultation;

- Costs incurred for cancelled projects;

- Expenditures related to purchasing land, buildings, and associated real estate and other fees;

- Leasing land, buildings, and other facilities; leasing equipment other than equipment directly related to the construction of the project; real estate fees and related costs;

- Any overhead costs, including salaries and other employment benefits of any employees of the eligible recipient or ultimate recipient, its direct or indirect administrative costs and more specifically its costs related to planning, engineering, architecture, supervision, management, and other activities normally carried out by its staff, with the following exceptions:

- There is a lack of private sector capacity to undertake the work; or

- The work involves project specific expertise, or proprietary or specialized infrastructure or equipment that requires specific knowledge or skill of the recipient’s employees; or

- A collective agreement requires the recipient to use their own unionized employees for certain project work.

- Financing charges, and loan interest payments, including those related to easements (for example, surveys);

- Legal fees, except for in the instances specified in Eligible Expenditures above;

- Principal and interest payments to the Canada Infrastructure Bank;

- Any goods and services costs which are received through donations or in kind;

- Provincial sales tax, goods and services tax, and harmonized sales tax for which the ultimate recipient is eligible for a rebate, and any other costs eligible for rebates;

- Costs associated with operating expenses and regularly scheduled maintenance work are ineligible with the exception of:

- essential capital equipment purchased at the onset of the construction/acquisition of the main asset and approved by Canada;

- operating costs including staff training, salaries and benefits, fuel, maintenance, repairs, and insurance associated with pilot projects undertaken by Indigenous recipients or Indigenous benefitting organizations.

- Cost related to furnishing and non-fixed assets which are not essential for the operation of the asset/project.

6.3 Non-Competitive Contracts

Recipients are expected to ensure that contracts are awarded in a way that is fair, transparent, competitive, and consistent with value-for-money principles, or in a manner otherwise acceptable to Canada. Use of non-competitive procurement (otherwise known as sole-source contracts) may be acceptable in select circumstances; however, funding recipients are encouraged to explore options to award contracts competitively to the extent possible. If you are planning on awarding non-competitive contracts as part of the project, you must confirm eligibility with the Government of Canada. Additional approvals may be required prior to the signature of contracts in order for these costs to be deemed eligible for federal reimbursement. Additional information may be required and approval delays may occur.

6.4 Reporting and Audit Requirements

Housing, Infrastructure and Communities Canada will utilize a risk-based approach to reporting, with detailed reporting requirements outlined in grant or contribution agreements, as applicable. Reporting requirements may include any of the following: annual and final reports, periodic progress reports and financial reports.

Housing, Infrastructure and Communities Canada, at its discretion, may conduct a recipient audit related to the agreement compliance.

6.5 Greenhouse Gas Mitigation and Buy Clean Reporting on Low-Carbon Materials

Investments in active transportation infrastructure help reduce greenhouse gas (GHG) emissions in the transportation sector by reducing private vehicle trips. In addition to the reductions created through modal shift from private vehicles to active transportation, projects can also reduce construction and operating emissions by implementing measures such as the use of low-carbon construction materials, use of low-emitting construction vehicles, or use of LED lighting to minimize energy consumption.

In the application, the applicant will attest to whether their project will meet the Buy Clean criteria (based on the information available at time of application). The projects that meet all of the following criteria will be required to use low-carbon ready-mix concrete and report on emissions from ready-mix concrete.

- Has a total eligible cost over $10 million;

- Is within a municipality with a population over 30,000; and

- Uses over 100 cubic meters (m³) ready-mix concrete

In the context of the program, low-carbon concrete refers to any ready-mix concrete solutions for which the total carbon footprint for all ready-mix concrete mixes used in a project is at least 10% below the baseline (based on the sum of regional industry average emissions for the strength class and the volume of all mixes placed).

After project funding approval, if applicable, HICC will validate whether Buy Clean reporting applies to the project, and will provide guidance and a reporting template.

6.6 Privacy Notice Statement and Confidentiality

The information you provide as part of the funding process is collected under the authority of the Department of Housing, Infrastructure and Communities Act for the purpose of administering the program. It may be used to evaluate, select and review applications under the program, monitor the progress of approved projects, and to coordinate administrative decisions with respective federal departments, crown corporations, provincial and or municipal counterparts/partners. Information may be shared with other federal government institutions, for the purpose of assisting Housing, Infrastructure and Communities Canada with project review and evaluation, determining eligibility under other federal government institutions' programs, and confirming past federal funding sought by an applicant. Housing, Infrastructure and Communities Canada may also disclose the information to external experts (e.g., scientific, technical, financial, marketing or commercialization) hired by the Government of Canada under contract with confidentiality obligations, for the purpose of assisting Housing, Infrastructure and Communities Canada with project review and evaluation and/or determining eligibility under other federal government programs. General information about approved projects including the name of the successful applicant, date of approval, the funding amount, project description and the location is proactively disclosed to the public once a funding agreement is signed. Other possible uses and sharing of personal information are described in the Housing, Infrastructure and Communities Canada Grants and Contributions Personal Information Bank. Failure to provide this information, and to consent to the collection, use and disclosure of this information, may result in the application not being further considered, and a delay in assessing your application for funding. You have the right to the correction of, access to, and protection of your personal information under the Privacy Act and to file a complaint with the Privacy Commissioner of Canada over Housing, Infrastructure and Communities Canada’s handling of your information as set out under the Privacy Act.

By submitting your application, you agree to the collection, use and disclosure of this information as outlined above.

Questions?

If you have any questions about the Active Transportation Fund that were not answered by this guide, please contact the ATF team at: ATF-FTA@infc.gc.ca.

Report a problem on this page

- Date modified: