Audit of Alternative Program Administration

Table of Contents

- Executive Summary

- Section I - Background

- Section II - Audit Objective and Scope

- Section III - Audit Approach

- Section IV - Audit Findings

- Delegated authorities and due diligence processes relative to authority streams and non-traditional recipients

- Milestone payments

- Section V - Conclusion and Recommendations

- Statement of Conformance

- Section VI - Management Response and Action Plan

- Annexes

- Annex A – Monetary value and risk of projects

- Annex B – Average Elapsed Time by Phase (Ministerial vs Streamlined Approval)

- Annex C – Delegation of Authority with Other Government Departments

- Annex D – Audit criteria and sub-criteria

- Annex E – Comparative Analysis of Forecasted vs Actual Expenditures Variance by Payment Type

Executive Summary

Introduction

Alternative Program Administration (APA) refers to departmental activities and practices in non-traditional areas including the selection, approval and management of agreements with non-traditional recipients in the public sector, non-profit private sector, and for-profit private sector. APA also refers to the use of innovative claim payment processes (i.e. milestone-based claims), to reduce the administrative burden while managing risk. These activities and practices are essential to support the timely delivery of projects and associated economic benefits as well as program objectives.

The objective of this audit is to provide reasonable assurance that Infrastructure Canada's (INFC) APA processes and controls for the management of contribution programs are effective and support the timely achievement of project outcomes and program objectives. Specifically, the audit seeks to determine whether:

- Delegated authorities and due diligence processes relative to authority streams and non-traditional recipients are aligned with departmental and project risks and enable the timely approval of projects;

- Processes and controls over milestone-based projects are conducive to the timely delivery of project outcomes and program objectives.

Findings related to delegated authority and due diligence processes:

- The Minister's delegated authorities for New Building Canada Fund (NBCF) projects with a federal contribution of less than $250M, and with non-traditional recipients (i.e. private for-profit) requiring Treasury Board (TB) approval, are not aligned with project risks;

- The average approval time was 331 days for a streamlined TB review and 349 days for a full TB submission, while it took 218 days to approve a project within ministerial authority; and

- Project approval processes by stream are consistent between programs and well-documented. However, operational guidelines and the Management Control Framework (MCF) for NBCF need to be updated to reflect roles and responsibilities under the current organizational structure.

Findings related to milestone-based payments:

- Milestone-based agreements were more effective than other agreements in forecasting planned expenditures against actuals. Over the reviewed period, a variance of -11% was observed between forecasted and actual expenditures for milestone-based agreements compared to a variance of -42% observed for other types of agreements (invoice-based and attestation-based);

- The review of a sample of projects has shown that milestone-based projects are more effective than invoice-based projects in terms of the timeliness of claim payments;

- The terms and conditions of milestone-based agreements have adequate controls and requirements to ensure that milestones are completed prior to payment of a claim; and

- Therefore, INFC would benefit from promoting the use of milestone payments for future projects, as appropriate, in order to reduce the administrative burden of invoice-based agreements and the amount of funding requiring re-profiling every fiscal year.

Recommendations

Project approval process and delegation of authority:

- The Assistant Deputy Minister (ADM), Program Operations Branch (POB), should develop a proposal for an alternative Ministerial delegation of authority with the objective of increasing the Minister's delegation subject to projects' risk level in order to accelerate the project approval process.

- The ADM, POB, should develop a mechanism to track progress of all key steps from the receipt of an application until approval by the Minister or by TB.

- The ADM, POB, should review and update procedural and governance documents (MCF, operational guides, etc.) to reflect current roles and responsibilities and corporate organizational structure.

Milestone-based payments:

- The ADM, POB, should develop and implement a framework for the management of milestone payments which includes:

- an approach to promote the use of milestones as an alternative basis of payment to invoice-based payments, depending on the nature and complexity of the project;

- a process to define realistic, clear and verifiable milestones and cash flows;

- a challenge function by a subject matter expert for proposed milestones and initial cash flow schedules, where required; and

- incentives and controls for the timely submission of claims.

Management Response

Management accepts the recommendations and an action plan has been put in place to address all of the recommendations.

The Management Action Plan can be found at the end of the report in Section VI.

Section I - Background

Context

Eligible recipients:

While the majority of INFC's programs are administered through bilateral agreements with provinces and territories, the Department sometimes makes exceptions for payments to non-traditional recipients such as not-for-profitFootnote 1 or for-profit organizations.Footnote 2

There is an opportunity to ensure that processes and controls related to projects with non-traditional recipients reinforce the timely realization of project outcomes and program objectives.

Delegation of authority:

The Building Canada Fund (BCF) was approved by the Treasury Board (TB), a Cabinet committee of the Queen's Privy Council of Canada, as a component of the Building Canada Infrastructure Plan on December 6, 2007. The BCF included three components: the Major Infrastructure Component (MIC), the Communities Component (CC), and the National Infrastructure Knowledge Component (NIKC). Under the MIC, CC and NIKC, the Ministers had delegated authority to approve, sign contribution agreements, and approve amendments for projects with a federal contribution from the BCF of up to $15M, and $50M for projects under the MIC's National Highway System Infrastructure (with the exception of ferries) and Local Road Infrastructure categories.

In June 2008, TB approved amendments to the BCF-MIC and increased the Minister's delegation of authority to enter into, and make amendments to, funding agreements for federal funding up to $50M. This delegation was later increased to $100M as part of the amendments to the BCF in 2009. This increased delegation was also applied to the Infrastructure Stimulus Fund (ISF) and the Green Infrastructure Fund (GIF) programs as part of the Economic Action Plan announced in 2009.

Under the New Building Canada Fund (NBCF), in effect since March 2014, the Minister has delegated authority to approve projects and sign agreements with a federal contribution up to and including $50M, subject to certain pre-defined exceptions. Since that time, TB has also approved other programs where the Minister was provided with delegated authority to approve projects with a federal contribution of up to $50M, subject to certain exceptions.

For most programs within the scope of this audit, during the Project Review and Approval phase (Stage 1), an initial project assessment of an application is carried out as the first step to determine whether the project proposal meets the basic program terms and conditions, and is eligible for funding. A detailed project review of a business case is conducted, as a second step, by INFC program analysts. As part of the detailed project review, program analysts must conduct a standardized risk assessment, which indicates the risk level and identifies proposed mitigation strategies and measures to be included in the Project Review Report (PRR). POB then presents the PRR to the INFC Project Review Panel (PRP), which presents the report to the Deputy Minister (DM) for his recommendation for approval by the Minister.

Once a project has been approved, the next phase includes INFC contacting the recipient to initiate the contribution agreement negotiations (Stage 2) in order to obtain the signatures from both parties on a legal document, which outlines their respective responsibilities and accountabilities in managing the project. Projects with a federal share of more than $50M and up to and including $250M follow a streamlined TB approval process. Such projects are recommended by the Minister to TB via the submission of INFC's PRR, which has been approved by the Minister. TB Secretariat representatives attend the PRP meetings where these projects are discussed. The representatives provide comments, and lead projects through the same briefing channels as regular TB submissions. Finally, projects above the $250M threshold and those that are exceptions to the terms and conditions of the programs, regardless of the funding level, must be approved by TB, and are presented using a full TB submission.

INFC has developed three distinct approval processes with threshold-based delegated authorities stipulated in the program terms and conditions. The process to approve lower risk projects offers an opportunity to avoid a non-aligned level of effort and approval time, irrespective of the federal contribution amount.

Claim payments:

In most instances, the basis for payments is upon receipt of invoice-based progress claims. However, exceptions exist, such as projects where payments are made upon the completion of predetermined milestones (i.e. easily-verifiable work elements as per the project contribution agreement's "Claims and Payments Schedule"). Milestone claims are supported by a certification of completion by an architect or engineer during the life of the project. Eligible costs associated with each anticipated milestone are negotiated during the project assessment, prior to the signature of a contribution agreement. Confirmation of eligible costs is undertaken at project completion through a special-purpose audit, before a holdback (usually between 10-20% of the federal contribution) is released.

Section II - Audit Objective and Scope

The overall objective of this audit is to provide reasonable assurance that INFC APA processes and controls for the management of contribution programs are effective and support the timely achievement of project outcomes and program objectives. Specifically, the audit seeks to determine whether:

- Delegated authorities and due diligence processes relative to authority streams and non-traditional recipient projects are aligned with departmental and project risks, and enable the timely approval of projects.

- Processes and controls over milestone-based projects are conducive to the timely delivery of project outcomes and program objectives.

The audit criteria (See Annex D for sub-criteria) are:

- Delegated authorities and due diligence processes for projects with a federal contribution of less than $250M requiring TB approval (including projects with non-traditional recipients) are aligned with project risks and support the timely roll out and efficient delivery of program implementation.

- Processes and controls over milestone-based projects are effective in mitigating project risks and conducive to the timely implementation of project outcomes and achievement of program objectives.

The audit scope considered the three approval processes that INFC used for approving 50 projects during the period of April 1, 2015 to February 15, 2017 under the New Building Canada Fund (NBCF), and the management of 11 active contribution agreements using milestone payments under the Building Canada Fund-Major Infrastructure Component (BCF-MIC) and Green Infrastructure Fund (GIF) programs, as well as the Inuvik to Tuktoyaktuk Highway project. In addition, the audit used the Office of the Comptroller General's most recent version of the Core Management Controls and relevant practices and reports from other Government of Canada departments and agencies in the development of the criteria.

Risk Assessment

Given the audit objective, the nature of the business processes involved and the operational conditions were reviewed to determine the inherent risks during the initial audit risk assessment. These risks are addressed in the audit program.

Potential Risk Events

- Risk Area 1: Effective controls may not exist to ensure that payments are made in accordance with the terms and conditions of the Agreement, the Financial Administration Act (FAA), the Treasury Board of Canada Secretariat (TBS) Policy on Transfer Payments, and departmental policies and procedures.

- Risk Area 2: POB may be unable to deliver infrastructure funding efficiently and in a timely manner.

- Risk Area 3: The monitoring of projects may not take into account the risk related to agreements' non-traditional terms and conditions and various recipient types.

- Risk Area 4: Project selection and approval processes, such as the PRP review and TB streamlined approach, do not support the timely roll-out and delivery of project outcomes and program implementation.

- Risk Area 5: Unsuitable projects and/or recipients are selected for milestone payments (inadequate risk assessment and selection of payment basis).

- Risk Area 6: The administration of complex projects is inadequate to meet agreement terms and conditions, and program administration is not effective.

- Risk Area 7: Funds are not used in accordance with Contribution Agreement's terms and conditions.

- Risk Area 8: There could be delays in project execution.

Section III - Audit Approach

The audit engagement was conducted in accordance with the Treasury Board Policy on Internal Audit and the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing.

The audit included various tests, as considered necessary, to provide reasonable assurance on the effective management of the programs. These tests included, but were not limited to, interviews, observations, walkthroughs, analytical reviews of supporting documentation, and attendance at key meetings.

The auditee received final audit findings on both criteria to validate facts and to confirm the clarity, accuracy, and completeness of the information reported.

Section IV - Audit Findings

Delegated authorities and due diligence processes relative to authority streams and non-traditional recipients

Audit Criterion #1

It was expected that:

Delegated authorities and due diligence processes for projects with a federal contribution of less than $250M requiring TB approval (including projects with non-traditional recipients) would be aligned with project risks and would support the timely roll-out and efficient delivery of program implementation.

Sub-criterion 1.1: Delegated authorities for projects with a federal contribution of less than $250M and projects with non-traditional recipients requiring TB approval, would be aligned with project risks.

Conclusion: Sub-criterion 1.1 was not met. The audit found that the Minister's delegated authority for projects with a federal contribution of less than $250M and with non-traditional recipients requiring TB approval, is not aligned with project risks. Consequently, current delegated authorities for these projects do not support the timely roll-out or efficient program delivery.

Impact: The Minister cannot approve some projects that are low risk, for example, projects with a federal contribution of less than $50M and intended for for-profit recipients. TB must approve the submitted projects, resulting in the use of additional INFC resources and delays, which reduces the efficiency of the project approval process.

The terms and conditions establish the delegated authorities in approved TB submissions relative to each program/fund and their components as applicable. Over time, the Minister's delegated financial authority has varied significantly between programs. The delegation proposed by INFC in TB submissions relies on direction provided by TB to describe the level of authority requested. The Minister's delegated authority for approving projects under the NBCF contribution programs is based primarily on the value of the federal contribution to specific projects, subject to exceptions such as (but not limited to) the recipient type, or the project being in the Minister's riding. The reasons for those exceptions were not clear based on the interviews with program delivery staff or from a review of TB submissions for NBCF.

The audit reviewed 25 projects that were approved through a full TB submission or a streamlined TB review between April 1, 2015 and February 15, 2017 with a total federal contribution of $2.4B. The review determined the monetary value and risk level of projects that had been subject to the TB approval processes. The audit found that for projects submitted to TB for approval, the criteria used in determining the Minister's delegation of authority ignored project risks, which results in numerous projects of lower monetary value and risk being submitted to TB for approval. A summary of the analytical review is available in Annex A.The review of these 25 projects showed the following:

| Less than $50M | $50M - $100M | $100M-$250M | Over $250M | Total | |

|---|---|---|---|---|---|

| # of projects | 10 |

9 | 4 | 2 | 25 |

| % of projects | 40% | 36% | 16% | 8% | 100% |

| Total amount contributed | $72M | $648M | $707M | $973M | $2.4B |

| % of $2.4B total | 3% | 27% | 29.5% | 40.5% | 100% |

Risk profile of projects approved by TB:

- Twenty projects (80%) had a stage 1 risk profile (project review and assessment phase) of either low or very low, and these 2 categories accounted for $1.65B or 69% of the total project contribution amount of $2.4B.

- Five projects (20%) had a stage 1 risk profile of medium and accounted for $750M or 31% of the total project contribution amount of $2.4B.

Where complete risk data was available, stage 1 assessed risk score decreased at stage 2 (contribution agreement negotiation) for about half of the projects, while the risk level remained the same for the other half of the projects. The data demonstrates that the risk profile of projects requiring TB approval is typically low or very low, does not increase over time and confirms that the delegated authorities are not aligned with the projects' risks.

Conclusion – Criterion 1.1: In conclusion, the Minister's delegation of authority is not aligned with project risks, but rather with the monetary value of the federal contribution and exceptions that are pre-defined in program terms and conditions.

Sub-criterion 1.2: INFC project due diligence processes by stream are documented and consistent between programs for projects of similar risk, size and complexity.

Conclusion: Sub-criterion 1.2 was partially met.

Project due diligence processes by stream are consistent between programs. Processes are also well documented.

However, operational guidelines and the Management Control Framework documents for NBCF need to be updated to reflect roles and responsibilities under the current organizational structure.

Impact: Program delivery staff may be unclear on their roles and responsibilities, especially given the recent hiring of new analysts. Also, existing documented processes are outdated and lead to inefficiencies in the approval process.

Although delegation thresholds may vary between programs, project approval processes (internal, streamlined TB or full TB process) are similar between programs once the authority required to approve a project is determined (i.e. Minister's authority vs. TB). The project approval process is based on the level of authority required, meaning it is based on the amount of the federal contribution and pre-determined exceptions rather than overall risk. Therefore, projects of similar size and risk to those approved internally, can be subject to TB approval processes, which creates inconsistencies in length and complexity of approval.

Processes for each approval stream are well-documented through a Management Control Framework (MCF), guides, flowcharts and checklists. While these provide sufficient detail on the project assessment and approval process, the audit found that some INFC program guidance documents did not reflect recent changes to roles and responsibilities. The audit also noted that INFC has developed guides such as the "NBCF Project Business Case Guide for Proposed Projects Identified by Provinces/Territories" to assist the recipients in the development of their projects' business cases. The use of these guides helps to clarify the type of information required from recipients when submitting a business case to INFC for review.

Conculsion – Criterion 1.2: In conclusion, INFC project due diligence processes by authority stream are well-documented and consistent between programs. However, the approval process is dependent on the level of authority required (Internal vs TB) which results in projects of similar risk, size and complexity being approved in different ways. This aspect will be explored further in the following section. Finally, although processes are generally well documented, some governance documents require updating to reflect recent changes in roles and responsibilities.

Sub-criterion 1.3: Due diligence processes for projects outside the Minister's delegated authority streams support the timely approval and implementation of projects and the delivery of program objectives.

Conclusion: Sub-criterion 1.3 was not met. TB due diligence approval processes for projects outside the Minister's delegated authority streams take an average of 56% or 122 calendar days longer than those approved by the Minister and increase INFC's level of effort by more than 300%. This increased level of scrutiny offers no evidence of a clear benefit given that most projects currently requiring TB approval are low-risk.

Important time lags exist during the INFC internal approval process between receipt of an application and when the business case review is completed. However, no formal process exists to monitor the time required to complete key steps during the project review by the various stakeholders. The portion of the time lags result during work done by INFC and what portion results from waiting for information from the proponents cannot be determined.

Impact: TB approval of low risk projects results in increased work for INFC and requires longer timeframes, which reduces the efficiency of the project approval process.

A longer process and increased level of effort reduce INFC's ability to deliver on program objectives in a timely manner. Furthermore, time lags also unnecessarily increase the workload of INFC staff when they require re-profiling of funds to future fiscal years.

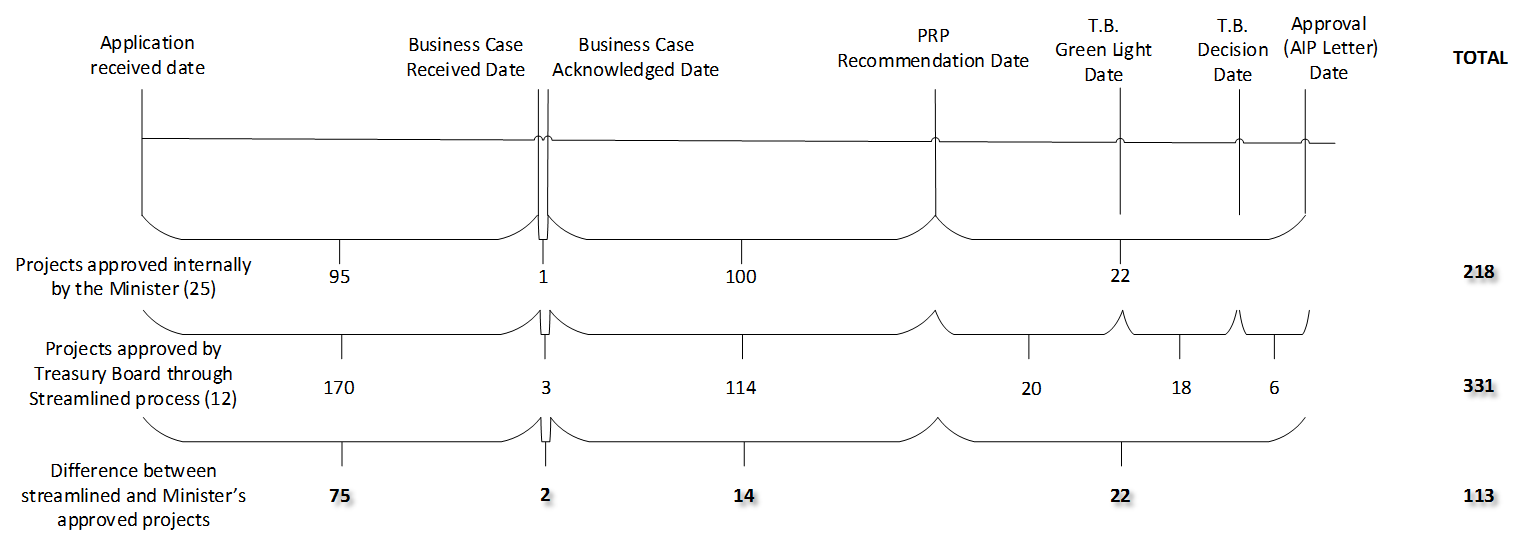

Project approval elapsed time: The audit determined that the average time for project approval for a streamlined TB review was 331 days, while a full TB submission required 349 days, for an average of 340Footnote 3 days for both approval streams. Alternately, the average elapsed time to approve a project within ministerial authority was 218Footnote 4 days.

Time required by Project Approval Stream

* days from receipt of the request until obtaining the letter of approval in principle.

Text description of Figure 1.

Figure 1 shows a comparison of the average time in calendar days required for each project approval stream at Infrastructure Canada, measured from receiving the application for funding to obtaining the approval in principle letter. It takes an average of 218 calendar days for approving projects (25) within the Minister's delegation of authority, 331 calendar days for projects (12) approved through a streamlined Treasury Board submission and 349 calendar days for projects (13) approved through a full Treasury Board submission.

The audit found that significant delays occur during two distinct phases of the project approval process:

- Between receipt of a proponent application and when the business case review is completed by INFC. These delays occur regardless of the approval process used.

- After INFC submits projects to TB, during the TB streamlined and full TB submission processes.

In the first case, delays are often due to missing information from the proponent, workload/ backlog, and priority projects. The project business case review phase accounted for 196 calendar days of the 218 days required to receive Approval in Principle from the Minister (See Annex B). Many of the events causing delays during the project review phase appear to be outside of the control of INFC personnel, based on interviews with program delivery staff.

Furthermore, although key milestones during the project approval phase are recorded, standards for those key milestones do not exist, nor is there a mechanism to monitor the events (stop the clock) that caused the delays. Therefore, the causes of delays and potential solutions to increase the efficiency of the process are difficult to analyze. Standards would ensure that the responsibilities and expectations of all stakeholders are defined.

In the second case, additional time lags are incurred after INFC submits projects to TB through the streamlined and full submission processes. Obtaining TB approval for projects outside the Minister's delegated authority streams takes an average of 56% or 122 calendar days longer than those approved by the Minister, and increase INFC's level of effort by more than 300%. TB does have service standards that allow INFC to plan ahead to a certain extent, but delays caused by additional questions from TB analysts are difficult to predict.

Although project information is shared with TB analysts one week prior to the PRP meetings for streamlined projects, as well as throughout the full TB submission preparation process, INFC analysts find it difficult to predict questions that will be raised by TB analysts during their formal project review process. Additional questions raised by TB result in additional effort and further delays for INFC to provide answers and obtain project approval from TB. Given that most projects currently requiring TB approval are low risk, no evidence exists of a clear benefit to this increased level of scrutiny. The department would benefit from exploring opportunities with TB to obtain advance feedback on upcoming projects, with the objective to anticipate TB analysts' questions and accelerate the approval process.

Level of effort: The level of effort can vary significantly between projects, and INFC does not have a time tracking system. Through interviews, the key approval steps were validated and an estimate of the level of effort (including senior management approval) for each approval stream was developed. This analysis showed that the level of effort ratio is 3.6 to 1 for a project requiring a full TB submission compared to a project approved within the Minister's delegation of authority.

These estimates are in the following table:

Level of Effort by Project Approval Stream

Text description of Figure 2.

Figure 2 shows the level of effort for approving projects by comparing the average number of business days required for each project approval stream at Infrastructure Canada. The level of effort is 13 business days for projects approved within the Minister's delegation, 20 business days for projects approved through a streamlined Treasury Board submission and 47.5 business days for projects approved through a full Treasury Board submission.

Given that most projects approved by TB are low risk, immediate savings in operating costs could be achieved by increasing the Minister's delegation of authority and allowing certain exceptions to be approved other than by TB. Based on a case study of projects approved by TB in 2016-17 (either streamlined or full submission), estimates show potential overall total savings of 1.47 full time employees (FTE)per yearbroken down as follows:

- Potential overall savings of 0.93 FTE's per fiscal year plus an average reduction of approval time of 113 days per project, if projects (excluding projects in the minister's riding) under $100M (streamlined or full submission) had been approved by the Minister.

- Additional 0.14 FTE's per fiscal year, if projects (excluding exceptions, such as in the Minister's riding and for-profit recipients) between $100M and $250M did not require TB streamlined approval.

- Additional 0.4 FTE's per fiscal year, if projects within Minister's riding were approved by the Deputy Minister.

The audit work also included a comparative analysis with other government departments (OGD's) pertaining to the delegation of authority of their contribution programs. It found that many of the constraints within INFC programs did not apply to OGD's, that very few projects required TB approval and that the ministerial delegation of authority limits were more appropriately aligned with the maximum project contributions allowed under the terms and conditions of those programs (see Annex C). For example, at Employment and Social Development Canada, the DM has delegated authority to approve eligible projects located within the Minister's riding. INFC could benefit from using a similar model.

Conclusion – Criterion 1.3: Significant variances exist in the time and the level of effort required to approve projects between INFC's internal process and TB processes. Due diligence processes for projects outside the Minister's delegated authority streams do not support the timely approval and implementation of projects and the timely delivery of program objectives. Savings in operating costs and reduced approval times could be realized should low risk projects currently approved by TB be approved by the Minister or potentially the Deputy Minister in certain cases.

Furthermore, standards for stakeholders and a process to monitor the causes for delays during the project approval process do not exist.

Recommendation 1:

The Assistant Deputy Minister (ADM), Program Operations Branch (POB) develop a proposal for an alternative Ministerial delegation of authority with the objective of increasing the Minister's delegation subject to a projects' risk level in order to accelerate the project approval process.

Recommendation 2:

The ADM, POB, develop a mechanism to track progress of all key steps from the receipt of an application until approval by the Minister or by TB.

Recommendation 3:

The ADM, POB, review and update procedural and governance documents (i.e. MCF, operational guides, etc.) to reflect current roles and responsibilities and corporate organizational structure.

Milestone payments

Audit Criterion #2

It was expected that:

- Processes and controls over milestone-based projects would be effective in mitigating project risks and conducive to the timely implementation of project outcomes and achievement of program objectives.

Sub-criterion 2.1: Processes and controls identifying the basis of payment (i.e. progress claims vs milestone based claims) would be clearly established and communicated.

Conclusion: Sub-criterion 2.1 was not met.

Formal processes and criteria to select the most suitable basis of payment for projects are not established or communicated.

Impact: The selection of the most suitable basis of payment for projects may not be appropriate and/or consistent between projects and regions. Opportunities to use milestone based payments and streamline/optimize the agreement administrative process may be missed.

INFC has traditionally reimbursed recipients upon the receipt of progress/invoice based claims. In recent years, milestones have been used as the basis of payment in 11 agreements. The choice of milestone-based payments was made based on circumstances that vary from project to project:

- One project (Alberta) was acquired as a legacy project from Western Development Canada.

- Six projects (Quebec and the Northwest Territories) were selected at the request of the recipient.

- Four projects (Ontario) are in a pilot study under way since 2013. No specific criteria were used to select the four milestone projects.

Conclusion - Criterion 2.1: Formal processes and criteria to choose the most suitable basis of payment for projects are not established. Clearly defined and well-communicated criteria would ensure that the method of payment for projects is selected in a consistent manner and that the administration of agreements is streamlined/optimized. Where terms and conditions of programs allow, having clear criteria could promote the use of milestones payments.

Sub-criterion 2.2: Processes and controls identifying the basis of payment (i.e. progress claims vs milestone based claims) would be clearly established and communicated.

Conclusion: Sub-criterion 2.1 was not met.

Formal processes and criteria to select the most suitable basis of payment for projects are not established or communicated.

Impact: The selection of the most suitable basis of payment for projects may not be appropriate and/or consistent between projects and regions. Opportunities to use milestone based payments and streamline/optimize the agreement administrative process may be missed.

The audit expected to find that milestones described in the agreements were easily-verifiable work elements as per the "Claims and Payments Schedule" included in the contribution agreements. While milestones and planned payments are described in the cash flow schedule in each project agreement, the audit found that the level of detail and clarity in the description of milestones was not consistent between projects. In some cases, the cash flow schedule included only a title for each milestone, without any description. A risk exists that expenditures claimed may not be properly supported if milestones have not been adequately defined.

In one case, payments spanning multiple fiscal years were planned for the same milestone, whereas by definition, a milestone is a scheduled event that indicates the completion of a major project deliverable. Therefore, it is impossible to validate the completion of a milestone and to clearly delineate milestone-specific expenditures paid through multiple payments in compliance with the terms and conditions of the agreement.

Furthermore, the identification of adequate milestones can be more difficult for complex projects and require in-depth technical and engineering knowledge to properly assess the risks associated with the proposed milestones. INFC program analysts, who are responsible for reviewing the adequacy of milestones with the recipient, may possess insufficient technical expertise to adequately assess what is being proposed, which increases project risks. INFC would benefit from seeking external technical expertise to assist program analysts in the assessment of the adequacy of milestones discussed during the negotiation of the contribution agreement, where relevant.

Conclusion – Criterion 2.2: Milestones should be clearly and concisely defined in order to ensure that their completion and the eligibility of expenditures reimbursed can be verified. Improvements are required to existing processes to ensure that for future projects with this method of payment, realistic milestones are developed in a consistent manner and have a high likelihood of being achieved in accordance with the agreement's initial terms and conditions.

Sub-criterion 2.3: Controls are in place to ensure that milestones are completed and costs are eligible prior to payment of a claim.

Conclusion: Sub-criterion was met. For all milestone-based projects tested, adequate controls and requirements existed within the agreements' terms and conditions to ensure that milestones are completed prior to payment of a claim.

At the time of payment of a claim, it is not possible to verify that costs are eligible. However, this risk is adequately mitigated as the agreements contain clauses allowing INFC to keep a financial "holdback" on amounts claimed and to ensure that reimbursed costs are audited at the end of a project.

Impact: Controls in place are adequate to minimize the risk that milestone completion is properly assessed and that payments made are for eligible costs.

The audit found that the following key controls and conditions are in place to ensure that milestones are completed and costs are eligible prior to payment of a claim:

- Recipients are required to establish a joint project management oversight committee led by a recipient co-chair and a federal co-chair. The committee is responsible for the oversight of the project, submitting required reports and project status updates to INFC, and attesting to the completion of milestones.

- Claim payments are based on milestone achievements as certified by an external architect or engineer (i.e. no invoice and no requirement to demonstrate eligible costs);

- Financial compliance audits are required at the end of each project and must include a final accounting of eligible costs reimbursed under the maximum federal contribution;

- The agreements include a maximum federal contribution clause which limits the federal contribution, and;

- The agreements include a final adjustment clause to allow for financial adjustments and/or claw-back.

The audit did note a discrepancy that may preclude the timely submission of claims by recipients based on the terms and conditions of milestone-based agreements. For the GIF agreements in Quebec, clause 6.3 stipulates that the recipient (province of Quebec) can submit any claim for payment to Canada at the latest 12 months following the end of the project without exceeding March 31, 2019. However, this clause is in contradiction with the Cash Flow Schedule A.2, which indicates in most cases an end date prior to March 31, 2019. Additionally, the schedule for milestones by fiscal year, included in Schedule A, clause 2.1, indicates that the last milestone #4, which represents the 20-40% holdback after receiving the final financial audit report, is to be paid in 2015-16 for the Rivière-du-Loup agreement and 2016-17 for Saint-Hyacinthe agreement. However, clause 8.2 indicates that the final financial audit report must be submitted to Canada no later than March 31, 2019, but the last milestone #4 could potentially be paid in 2015-16 or 2016-17, which would be prior to receiving the financial audit report.

INFC would benefit from clarifying these clauses in the agreement's terms and conditions to ensure they are not in contradiction. Furthermore, as mentioned under sub-criterion 2.2, another area for improvement involves instances where the payments spanning over multiple fiscal years were planned for the same milestone. Additional precision in the determination of milestones, to ensure a consistent approach is applied in all milestone-based projects when initially establishing the schedule of milestones, would be beneficial.

Conclusion – Criterion 2.3: The audit found that adequate controls and conditions are in place to ensure that milestones are completed and costs are eligible prior to payment of a claim.

Sub-criterion 2.4: Milestones are effective and conducive to the timely implementation of projects.

Conclusion: Sub-criterion 2.4 was partially met.

The milestone-based payment is an effective and valuable tool to manage contribution payments, while reducing the administrative burden of reviewing and approving claims. However, the audit found that many claims were not submitted in accordance with the initial agreement's terms and conditions, but were instead submitted at a later date. As a result, the cash flow schedules of agreements were amended, and in some cases the changes in dates triggered formal amendments to the agreements.

NOTE: Subject to the above conclusion, the review of a sample of projects has shown that milestone-based projects are more effective than invoice-based projects in terms of the timeliness of claim payments.

Impact: Claims (invoice-based and milestone-based) not submitted by the recipient as per the agreements' schedules can result in program funds not being spent in accordance with the annual Departmental financial plan and the re-profiling of program funding to future fiscal years. This increases the workload for INFC staff and creates inefficiencies.

The audit found that milestone-based agreements were more effective than other agreements in forecasting planned expenditures against actuals as shown in Annex E. Over the period reviewed, a variance of -11% was observed between forecasted expenditures at the time of the signature of the contribution agreement (or subsequent amendments) and actual expenditures for milestone-based agreements compared to a variance of -42% observed for other types of agreements (invoice-based and attestation-based).

The co-chairs of the Oversight Committees, in all eleven milestone agreements reviewed, updated/amended and approved the cash flow schedules. However, only three formal amendments were required to extend those agreements' end dates. All amendments resulted in the re-profiling of program funds.

Cash flow schedules were updated/amended and approved by the co-chairs of the Oversight Committees, in all ten of the invoice-based agreements reviewed. Nine formal amendments were required to extend the invoice-based agreements' end dates. All amendments resulted in the re-profiling of program funds. INFC would benefit from developing incentives and controls to ensure the timely submission and payment of all claims.

Through interviews, the audit found that the approval of milestone-based claims required only the review by program analysts of milestone completion certification documents provided by the recipient, which requires less time and effort (less than one business day), compared to the review and approval by the Claims Review Unit of documentation provided in support of an invoice-based claim (four to five business days on average). The milestone-based claim results in a significant benefit, which provides an opportunity for INFC to reduce the administrative burden of the claims review and approval process and generate operating cost savings.

Conclusion – Criterion 2.4: Milestone-based payments are a valuable tool for managing contribution agreements when used for suitable projects. However, improvements are required to ensure that milestones are realistic and achievable, and that claims are submitted and payments are made in accordance with the initial cash flow schedules, in order for projects to be implemented in a timely manner (i.e. avoid re-profiling of funds). INFC would benefit from promoting the use of milestone payments for future projects as appropriate, in order to reduce the administrative burden of invoice-based agreements, and to minimize departmental re-profiling of program funds.

Recommendation 4:

The ADM, POB, develop and implement a framework for the management of milestone payments, which includes:

- an approach to promote the use of milestones as an alternative basis of payment to invoice-based payment, depending on the nature and complexity of the project;

- a process to define realistic, clear and verifiable milestones and cash flows;

- a challenge function by a subject matter expert for proposed milestones and initial cash flow schedule, where required, and;

- incentives and controls for the timely submission of claims.

Section V - Conclusion and Recommendations

Overall, the audit concluded that sufficient INFC Alternative Program Administration controls and processes are in place for managing contribution programs. However, those controls and processes were not always effective in supporting the timely achievement of project outcomes and program objectives.

For the delegation of authority criterion, the audit concluded that there are inefficiencies in INFC's process to obtain TB approval for projects with similar levels of risk, scope, and complexity, which could otherwise be approved by the Minister. Given resources available, the additional level of effort that is required to obtain TB approval for projects outside the Minister's delegation of authority results in delays in obtaining approval for similar projects within the Minister's delegated authority. INFC governance documentation related to project due diligence (selection and approval) processes by approval stream are well documented but need to be updated to reflect recent changes in roles and responsibilities.

Additionally, for the milestone-based payments, the audit concluded that this method of payment leads to less re-profiling than other payment types and may be a more optimal tool in managing claim payments. Adequate controls exist within milestone-based agreements to ensure that, for each milestone completed, attestation documents are required (i.e. Schedule E – Declaration of Milestone Completion). Furthermore, effective oversight processes and controls are in place to monitor project progress and the timely implementation of agreements. However, formal processes and guidance to choose the basis of payment (i.e. progress claims vs. milestone based claims) are not clearly established and communicated. The level of detail and clarity in the description of milestones is inconsistent between projects. Improvements are required to existing processes to ensure milestones are developed in a consistent manner. Milestones have a higher likelihood of being achieved in accordance with the initial cash flow schedule, and claims are submitted and payments are made in a more timely manner than invoice-based payments.

There are four recommendations for the ADM of POB:

Project approval process and delegation of authority:

- The ADM, POB, develop a proposal for an alternative Ministerial delegation of authority with the objective of increasing the Minister's delegation subject to projects' risk level in order to accelerate the project approval process.

- The ADM, POB, develop a mechanism to track progress of all key steps from the receipt of an application until approval by the Minister or by TB.

- The ADM, POB, review and update procedural and governance documents (MCF, operational guides, etc.) to reflect current roles and responsibilities and corporate organizational structure.

Milestone-based payments:

- The ADM, POB, develop and implement a framework for the management of milestone payments which includes:

- an approach to promote the use of milestones as an alternative basis of payment to invoice-based payment, depending on the nature and complexity of the project;

- a process to define realistic, clear and verifiable milestones and cash flows;

- a challenge function by a subject matter expert for proposed milestones and initial cash flow schedule, where required, and

- incentives and controls for the timely submission of claims.

Management response: Management accepts the recommendations. An action plan has been put in place to address all of the recommendations.

Statement of Conformance

The audit conforms to the International Standards for the Professional Practice of Internal Auditing and the Internal Auditing Standards for the Government of Canada as supported by the results of the quality assurance and improvement program.

___________________________________________

Michèle Serano (CGA-CPA, CIA, CRMA, CCSA)

Director, Internal Audit

___________________________________________

Isabelle Trépanier

Chief Audit and Evaluation Executive

Section VI - Management Response and Action Plan

| # | Recommendation | Management Response and Action Plan | OPI and Due Date |

|---|---|---|---|

| 1 | The Assistant Deputy Minister (ADM), Program Operations Branch (POB) develop a proposal for an alternative Ministerial delegation of authority with the objective of increasing the Minister's delegation subject to projects' risk level in order to accelerate the project approval process. | Management agrees with the recommendation. POB and Corporate Finance will undertake an analysis of projects that exceeded Ministerial delegation of authority in order to build a business case for a proposal to Treasury Board Secretariat (TBS) to increase Ministerial delegation for projects. This analysis would include a review of past projects in terms of scope and complexity, type of recipients, risk profiles, length of time for approvals, and FTE requirements to prepare submissions. This analysis would build on previous analysis of delegations in order to support a future proposal to TBS. |

ADM, POB ADM, CSB Targeted completion date: October 31, 2018 |

| 2 | The ADM, POB develop a mechanism to track progress of all key steps from the receipt of an application until approval by the Minister or by TB. | Management agrees with the recommendation. Using lessons learned from the implementation of the NBCF, POB will develop a program progress tracker for its new programs that will serve to track activities and controls/decision points, namely for:

|

ADM, POB Targeted completion date: June 30, 2018 |

| 3 | The ADM, POB, review and update procedural and governance documents (MCF, operational guides, etc.) to reflect current roles and responsibilities and corporate organizational structure. | Management agrees with the recommendation.

POB will update NBCF's PTIC-NRP/NIC Management Control Framework (June 2015) to reflect current roles and responsibilities. |

ADM, POB Targeted completion date: December 31, 2017 |

| 4 | The ADM, POB, develop and implement a framework for the management of milestone payments, which includes:

|

Management agrees with the recommendation. POB acknowledges that milestone payments are best adapted to the nature, scope and complexity of infrastructure projects. Using its past experiences with a wide array of claims reimbursements processes, POB has developed a progress based approach for processing contributions payments that is comparable to milestone based payment. Starting with PTIC-SCF (a program under the New Building Canada Fund), INFC has been processing claims based on provincial/territorial progress in implementing the program. This new process relies on provinces and territories to submit claims according to their progress and to attest that use of funds is in compliance with SCF requirements. This claim payment approach is also in place for the Investing in Canada Phase 1 programs and will be used under Phase 2. As such, POB proposes to undertake an internal review of the progress based payment process to ascertain that it is effective and sufficiently robust to ensure timely flow of funds and preserve accountabilities. |

ADM, POB Targeted completion date: March 31, 2018 |

Annexes

Annex A – Monetary value and risk of projects

Analysis of the monetary value and risk of projects submitted to TB for approval from April 1, 2015 to February 15, 2017:

| Federal Contribution (FC) | Approval process | Projects by risk category | Total | |||

|---|---|---|---|---|---|---|

| Very Low | Low | Medium | ||||

| $0 < FC < $50M | Streamlined | 1 | 1 | |||

| Full | (1) | 1 | 7 | 1 | 9 | |

| $50M < FC < $100M | Streamlined | (2) |

6 | 1 | 7 | |

| Full | 1 | 1 | 2 | |||

| $100M < FC < $250M | Streamlined | (3) | 1 | 2 | 1 | 4 |

| Full | 0 | 0 | 0 | 0 | ||

| $250M < FC | Full | 0 | 1 | 1 | 2 | |

| Sub - Total | Streamlined | 2 | 8 | 2 | 12 | |

| Sub – Total | Full | 1 | 9 | 3 | 13 | |

| Total | 3 | 17 | 5 | 25 | ||

(1) 8 out of 10 projects with a federal contribution of less than $50M were approved through a full TB submission, although the risk was assessed as low or very low.

(2) projects with a federal contribution between $50M and $100M, with medium risk assessments were submitted through a different TB approval processes.

(3) 1 project with a federal contribution between $100M and $250M with a medium risk assessment was submitted through TB's streamlined approval processes.

Annex B – Average Elapsed Time by Phase (Ministerial vs Streamlined Approval)

align="center">Project Approval Process - Average elapsed time in calendar days

Text description of Figure 3.

Figure 3, shows the average time elapsed, in calendar days, by phase for the project approval process at Infrastructure Canada.

For projects approved within the Minister's delegation, 218 calendar days had elapsed between the time an application was received and approved, broken down by phase as follows:

- 95 calendar days elapsed between the application being received and receipt of the business case;

- 1 calendar day elapsed between the date a business case was received and the date it was acknowledged by program delivery staff;

- 100 calendar days elapsed between the date a business case was acknowledged and was recommended for approval by the Project Review Panel (PRP);

- 22 calendar days elapsed between the date a business case was recommended for approval by PRP and approved by the Minister with an approval in principle letter.

For projects approved by Treasury Board through the streamlined process, 331 calendar days elapsed between the time an application was received and approved, broken down by phase as follows:

- 170 calendar days elapsed between the application being received and receipt of the business case;

- 3 calendar days elapsed between the date a business case was received and the date it was acknowledged by program delivery staff;

- 114 calendar days elapsed between the date a business case was acknowledged and was recommended for approval by the Project Review Panel (PRP);

- 44 calendar days elapsed between the date a business case was recommended for approval by PRP and approved by the Minister with an approval in principle letter.

- 20 calendar days had elapsed between the date a business case was recommended for approval by PRP and subsequently approved by the Treasury Board;

- 18 calendar days had elapsed between obtaining Treasury Board approval and the Treasury Board decision date; and

- 6 calendar days between the Treasury Board decision date and the approval by the Minister through an approval-in-principle letter.

The difference between the two approval streams was 113 calendar days in average elapsed time for the full project approval process.

Annex C – Delegation of Authority with Other Government Departments

| Infrastructure Canada (INFC) | Transport Canada (TC) | Indigenous and Northern Affairs Canada (INAC) | Employment and Social Development Canada (ESDC) | Agriculture Canada (AC) | |

|---|---|---|---|---|---|

| Minister's Delegation of Authority (DoA) | Minister can approve projects up to $50M* under NBCF, PTIF, CWWF | Minister can approve projects up to $100M | Minister can approve projects up to $125M/year/recipient under the Capital Facilities Maintenance Program (CFMP) | Minister has full DoA (no maximum amount threshold but subject to the authority of the programs' Ts&Cs for the maximum amount payable) | Minister can approve projects up to $50M / Ts&Cs allow for a maximum contribution amount of $10M per year for a maximum of 5 years |

| DM | $0 | Unknown | Unknown | Full when a project originates within Minister's riding, $25k- $100k depending on the program | Unknown |

| ADM | $0 | Unknown | Unknown | $25k- $100k depending on the program | $2M |

| DG | $0 | Regional Director General will approve projects being considered for funding from the Airports Capital Assistance Program | Unknown | $25k for one program | $500k |

| Director | $0 | Unknown | Unknown | Unknown | Unknown |

| TB approval (2015-16 & 2016-17 | 25 (12 streamlined / 13 full TB submissions) | Only 2 projects | None | None | One |

| Largest project approved since April 1, 2015 | $582.9M (Southwest Calgary Ring Road project) | $232M (15 combined projects) / Only 3 projects over $50M were approved by TC since April 1, 2015. | $123.5M (grant) | $10M, with an average contribution amount per project of $422k | $12.7M |

| Exceptions |

|

An exception from the above, TC has two contribution funding programs that require TB approval for projects. The two programs provide funding for transportation infrastructure projects:

|

No exceptions exist | When a project is within Minister's riding, the Deputy Minister has delegated authority to approve | No exceptions exist |

DoA = Delegation of Authority; CA = Contribution Agreement

*subject to exceptions such as projects within Minister's riding and for-profit recipients

Annex D – Audit criteria and sub-criteria

| Criteria | Sub-criteria |

|---|---|

|

1.1 Delegated authorities for projects with a federal contribution of less than $250M and projects with non-traditional recipients requiring TB approval, are aligned with project risks. |

| 1.2 INFC project due diligence (selection and approval) processes by stream are documented and consistent between programs for projects of similar risk, size and complexity. | |

| 1.3 Due diligence processes for projects outside the Minister's delegated authority streams support the timely approval and implementation of projects and the delivery of program objectives. | |

|

2.1 Processes and controls to choose basis of payment (i.e. progress claims vs milestone-based claims) are clearly established and communicated. |

| 2.2 Processes in place support the development of realistic project milestones. | |

| 2.3 Controls are in place to ensure that milestones are completed and costs are eligible prior to payment of a claim. | |

| 2.4 Milestones are effective and conducive to the timely implementation of projects. |

Annex E – Comparative Analysis of Forecasted vs Actual Expenditures Variance by Payment Type

*Other payment type includes invoice-based and attestation-based payments

| Forecast P12 for 2014-15 & 2015-16; P10 for 2016-17 |

Expenditures Year End |

||||||

|---|---|---|---|---|---|---|---|

| Final Authority | Milestone | Other | Milestone | Other | Variance for Milestone | Variance for Other | |

| BCF-MIC | $2,188,854,869 | $104,153,735 | $1,932,687,748 | $84,808,945 | $1,170,864,628 | -18.6% | -39.4% |

| CSIF | $481,943,045 | $ - | $456,833,565 | $ - | $375,106,908 | N/A | -17.9% |

| GIF | $225,951,529 | $16,654,764 | $128,192,106 | $ - | $48,240,242 | -100.0% | -62.4% |

| NIC | $165,900,000 | $ - | $16,740,755 | $ - | $ 3,069,122 | N/A | N/A |

| NRP | $668,225,948 | $ - | $282,495,144 | $ - | $52,595,443 | N/A | -81.4% |

| ITH | $187,650,000 | $166,275,000 | $49,875,000 | $170,000,000 | $ - | 2.2% | -100.0% |

| GRAND TOTAL | $3,918,525,391 | $287,083,499 | $2,866,824,318 | $254,808,945 | $1,649,876,344 | -11.2% | -42.4% |

Variance between forecasted and actual expenditures

Text description of Figure 4.

Figure 4 shows the variance (in percentage) between the forecasted and actual expenditures for milestone vs invoice-based payments in fiscal years 2014-15, 2015-16 and 2016-17.

| Fiscal Year | Variance for Milestone | Variance for Other |

|---|---|---|

| 2014-15 | 5.6% | -13.7% |

| 2015-16 | -2.1% | -11.4% |

| 2016-17 | -38.9% | -71.1% |

- Date modified: